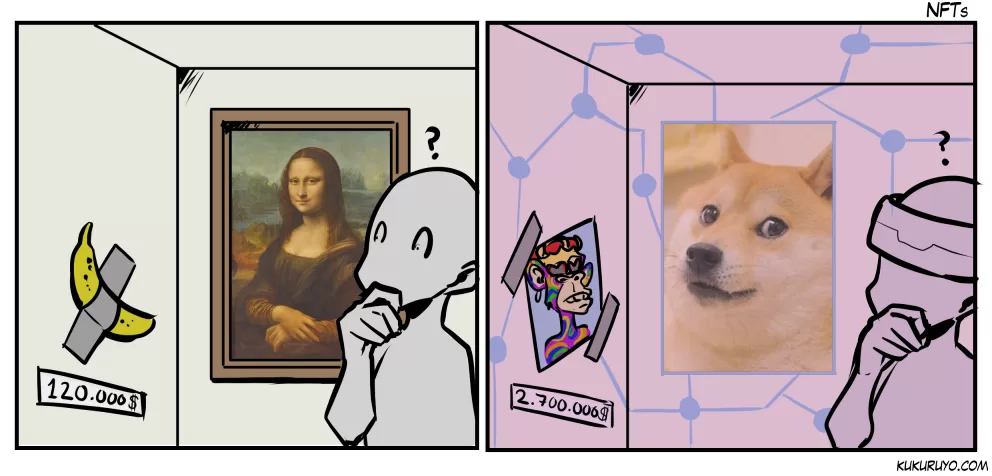

Non-fungible token (NFTs) are digital assets that are stored on a blockchain and have unique identification codes that make them non-interchangeable. They can represent various forms of digital or real-world content, such as art, music, games, or identity documents. NFTs have gained popularity in recent years as a way to create digital scarcity, prove ownership, and monetize creativity.

The profitability of NFTs is not guaranteed and depends on various factors, such as the demand and supply of the market, the quality and originality of the content, the reputation and influence of the creator, and the platform and network effects. NFTs are also subject to volatility, regulation, and environmental concerns, as they consume a lot of energy and resources to be minted and traded on the blockchain.

According to a report by the World Economic Forum, the NFT market reached a peak of $2.5 billion in sales in the first half of 2021, but then declined by 90% in June. The report also states that the majority of NFTs are concentrated in a few categories, such as gaming, art, and sports, and that most of the value is captured by a small number of creators and collectors. The report suggests that NFTs need to diversify their use cases, improve their user experience, and address their social and environmental impact to achieve long-term sustainability and growth.

Non-fungible token still profitable nowadays?

As we step into 2024, the once-blazing trail of non-fungible tokens (NFTs) appears to have dimmed somewhat compared to the fervor of the previous year. The market dynamics have shifted, and the euphoria surrounding NFTs seems to have cooled down. But, whether NFTs remain profitable or not is a nuanced matter.

Just like the shifting winds that influence any market, the profitability of NFTs is subject to various factors. The trend might be a bit subdued now, but there could be potential sparks—some catalysts that could reignite the fervor and drive Non-fungible token back into the spotlight.

It’s crucial to keep an eye on emerging trends, technological advancements, and evolving consumer behaviors, as they often serve as triggers that can elevate the appeal and profitability of NFTs. So, while the NFT landscape may not be as dazzling as it once was, the potential for resurgence lies in the unforeseen developments that could act as a catalyst for another NFT boom. Stay tuned, as the story of NFTs in 2024 unfolds with its own twists and turns.

NFTs Site

In my opinion, NFTs will never reach the peak like they did in 2021. Because of the many new developments now, the likelihood of them reaching that pinnacle again seems very slim. They might still exist, but not with the same magnitude. But, in reality, NFTs are good to storing digital assets, considering their blockchain algorithm is excellent for determining ownership. So, it’s not wrong to store digital assets there, but it’s not advisable to expect them to sell at fantastic prices as reported in the news.

If you’re interested in storing your digital assets as non-fungible tokens, I’ll tell you how and where you can do it. But first, you need to create some crypto wallet to connect NFTs provider. You can read Best Crypto Wallet, after it lets go to the list :

OpenSea

The biggest player in the NFT game, OpenSea supports a diverse range of non-fungible tokens, covering art, gaming, sports, and collectibles. It works with both ERC-721 and ERC-1155 tokens on Ethereum and Polygon blockchains. Keep in mind, there’s a 2.5% marketplace fee for each sale.

Crypto.com

A top-tier NFT marketplace, Crypto.com provides a secure and reliable platform for trading your digital assets. It accommodates various NFT categories like art, celebrities, music, and sports. Running on the Crypto.org Chain blockchain, it does charge a 15% primary listing fee.

Binance

Binance isn’t just for trading cryptocurrencies; it’s a hub for creating, buying, and selling NFTs on the Ethereum blockchain. You can find NFTs spanning music, videos, domains, and real-world objects. Plus, it allows the transfer of NFTs between two blockchains. Keep in mind there’s a 1% fee for transactions on the Binance NFT marketplace.

Conclusion

The trajectory of non-fungible tokens (NFTs) has experienced both peaks and troughs, with the market dynamics shifting over time. The profitability of NFTs is not a guaranteed constant and is influenced by factors such as market demand, content quality, creator reputation, and environmental considerations.

While the NFT market witnessed a significant surge in sales in the first half of 2021, subsequent reports indicated a decline. The concentration of NFTs in specific categories and the unequal distribution of value among creators and collectors raise concerns about the sustainability and long-term growth of the NFT ecosystem.

As we step into 2024, the NFT landscape appears to have cooled compared to the previous year. The potential for resurgence remains, contingent on emerging trends, technological advancements, and shifts in consumer behavior. NFTs have proven to be valuable for storing digital assets, leveraging blockchain algorithms for secure ownership verification.